Arizona Charitable Tax Credit: Support Our Community Through Duet

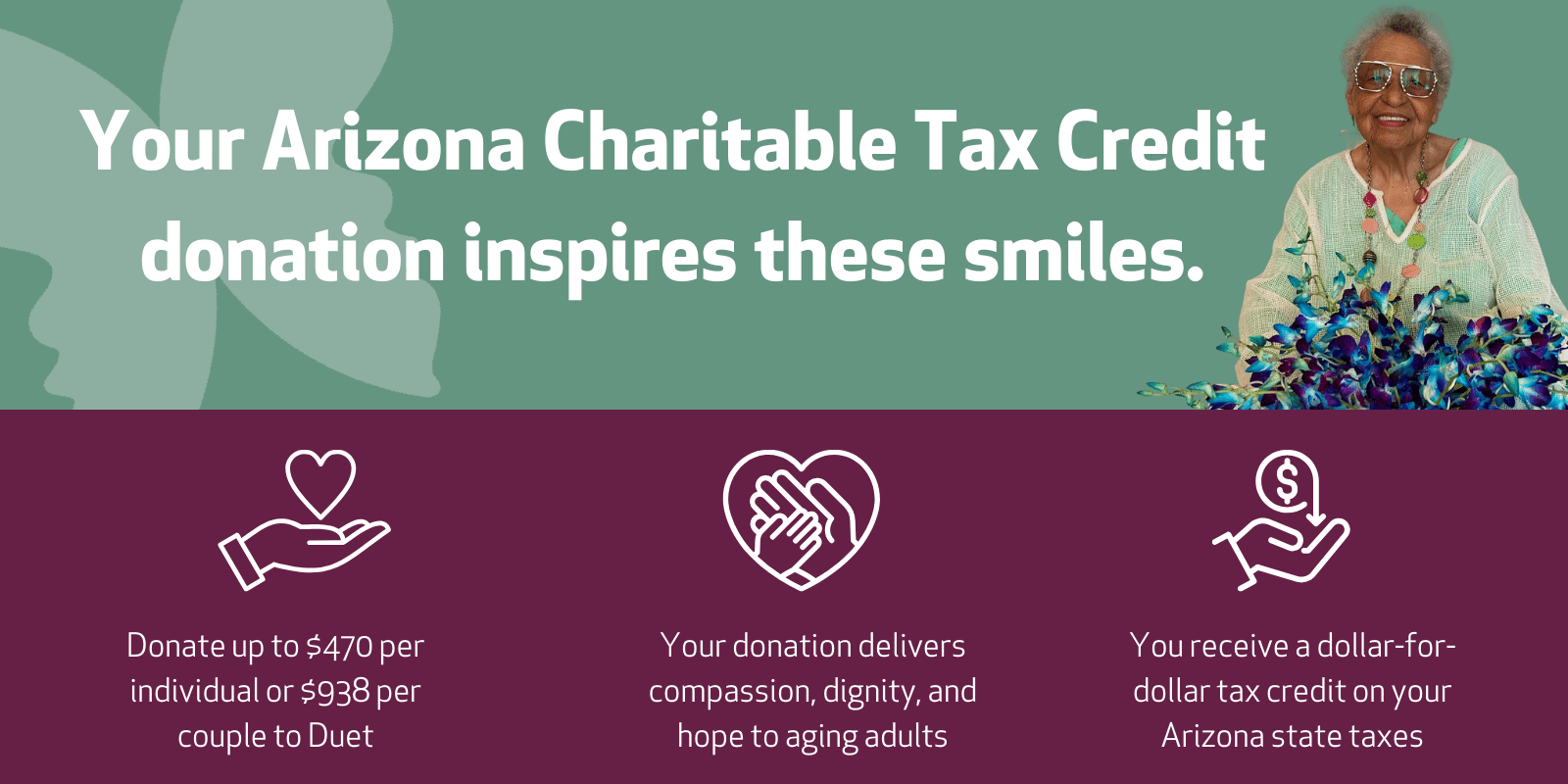

Deliver Compassion, Dignity, and Hope with your Arizona Tax Credit

No one should have to face life’s challenges alone. You can deliver compassion, dignity, and hope to homebound adults, family caregivers, and grandparents raising grandchildren right here in our community and receive a dollar-for-dollar state tax credit. Duet is an Arizona Qualifying Charitable Organization (QCO), which benefits you when you donate.

Please Note: Arizona law allows QCO donations made during 2024 or donations made from January 1, 2025 through April 15, 2025 to be claimed on the 2024 Arizona income tax return. The maximum credit that can be claimed on the 2024 Arizona return for donations made to QCO’s is $470 for single, married filing separate or head of household taxpayers, and $938 for married filing joint taxpayers.

- You do not have to itemize

- This tax credit may be claimed in addition to school and foster care tax credits

- Duet’s QCO code is 20552 to place on form 321 when filing your state return

**Consult your tax advisor or the Arizona Department of Revenue website for more information and advice on a specific situation.

Frequently Asked Questions

What is the Arizona Charitable Tax Credit?

The Arizona Charitable Tax Credit allows individuals to reduce their state tax liability by making eligible contributions to qualifying charitable organizations (QCOs). When you donate to a certified QCO, you can receive a dollar-for-dollar credit against the taxes you owe to the state of Arizona. This tax credit not only benefits you financially but also supports vital community services provided by certified organizations, making a significant impact on the lives of Arizonans in need.

How Much Can I Donate For Arizona Tax Credit

Individuals can donate up to $470, and married couples filing jointly can donate up to $938. These limits apply to donations made to Qualifying Charitable Organizations, allowing you to reduce your state tax liability dollar-for-dollar up to these amounts.

Can I claim the Arizona Charitable Tax Credit in addition to other tax credits?

Yes, the Arizona Charitable Tax Credit can be claimed in addition to other state tax credits such as the Public School Tax Credit and the Foster Care Tax Credit. This allows you to maximize your contributions across different sectors and reduce your tax liability further.

What are the deadlines for making an Arizona tax credit donation?

To claim your tax credit for the current tax year, Arizona tax credit donations must be made by April 15 of the following year. This gives you the flexibility to plan your contributions and ensure you receive the credit in a timely manner.

How do I claim the Arizona Charitable Tax Credit?

To claim the credit, you need to complete the Arizona Form 321 for donations made to QCOs. You must attach this form to your state tax return. Be sure to keep all receipts and documentation related to your donations for record-keeping.

Are payroll deductions eligible for the Arizona Charitable Tax Credit?

Yes, if your employer offers a payroll deduction plan for donations, you can make contributions directly from your paycheck to eligible Qualifying Charitable Organizations (QCOs). These payroll deductions simplify the donation process and allow you to make regular contributions throughout the year. While these deductions do not reduce your taxable income like some other pre-tax deductions, they do qualify for the Arizona Charitable Tax Credit, which reduces your state tax liability dollar-for-dollar based on the amount donated.

Do I need to itemize my deductions to claim this credit?

No, you do not need to itemize deductions on your tax returns to claim the Arizona Charitable Tax Credit. This makes the credit accessible even if you opt for the standard deduction, simplifying your tax filing process while still allowing you to benefit from your charitable contributions.

What qualifies an organization for the Arizona Charitable Organization Tax Credit?

To qualify for the Arizona Charitable Organization Tax Credit, an organization must be certified as a Qualifying Charitable Organization (QCO) by the state of Arizona. These organizations are typically those that provide immediate basic needs to residents of Arizona, such as food, clothing, shelter, and health care. Donating to these certified organizations allows taxpayers to claim a dollar-for-dollar tax credit, effectively reducing their state tax liability while supporting vital community services.